The Friday Fast Five | RBI Vs Fintech

First, a note from the editor: What do you think of this newsletter? Please hit reply and tell us - your feedback will help us make this an even better reading experience!

#1 RBI dampens Fintech dreams?

The Indian fintech landscape is said to be growing at an aggressive pace, aided by innovative technological solutions. Its market size is expected to reach ~$ 150 Bn by 2025.

However, not all is rosy on the Fintech horizon. Last week, RBI issued a new guideline under which all Prepaid Payment Instruments (PPI) henceforth have to be loaded only via banking instruments e.g., account transfers, debit cards, and credit cards. Non-banking entities used credit lines to load PPIs to date, which allowed them to offer the “Buy Now Pay Later” option to customers. As the fintech lending ecosystem is heavily dependent on credit lines through wallets, RBI’s latest diktat could restrain the growth of fintech startups including unicorns in the likes of Paytm, PhonePe, MobiKwik.

The guideline is said to be a regulatory mechanism employed to compel Fintech companies to adopt a more robust risk management discipline. It also seems like RBI is dubious about the economic sustainability of digital-only banks, even though in 2021, Niti Aayog had proposed to set up the same.

Industry experts are divided on the issue if this rule will put banks in an advantageous position over Fintechs or ensure a level playing field.

Nevertheless, this directive will impact the business models of startups who will now have to reinvent and rapidly adapt to avoid disruptions in their future game plan.

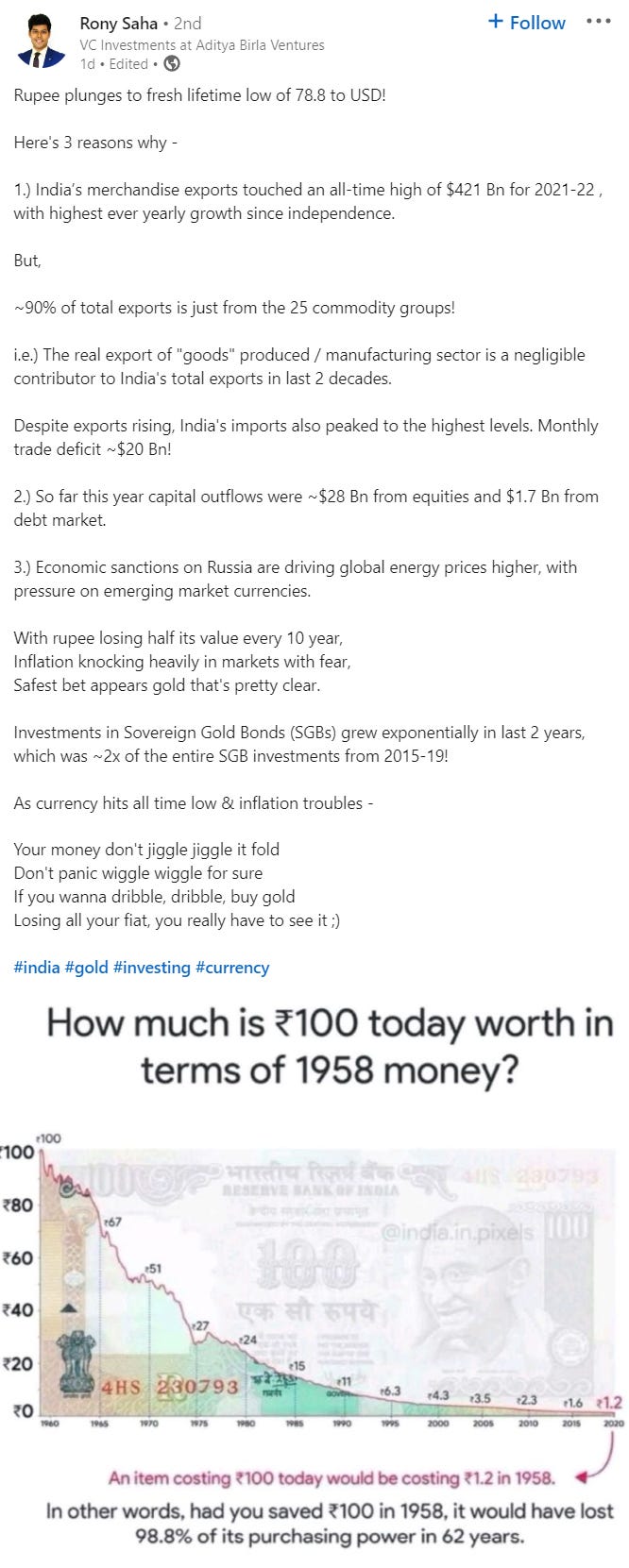

#2 LinkedIn Post of the week

#3 Podcast of the week

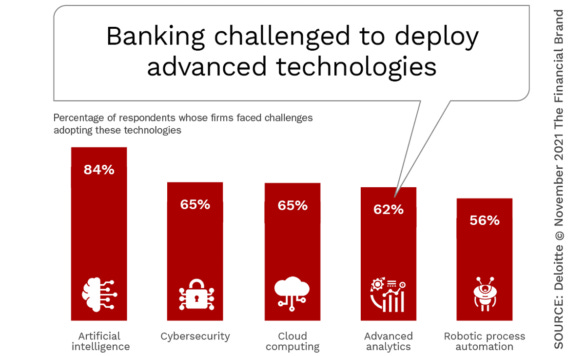

Interventions built upon Artificial Intelligence (AI), Machine Learning (ML), Blockchain, etc. have revolutionized the banking sector. Banks have remolded themselves to become financial service providers by the implementation of smart solutions in their products.

Sarvatra Technologies is a company pioneering the evolution of tech in banking since 2000. Listen to Mandar Agashe, Founder and Vice Chairman of Sarvatra Technologies, speak about how his company is promoting financial inclusion for the country’s underbanked population through its unique innovative banking products.

#4 Meme of the week

#5 Human of the week

Shaktikanta Das is the 25th and the present governor of the Reserve Bank of India (RBI). Prior to that, he served as a member of the 15th Finance Commission and was India’s Sherpa to the G20. A postgraduate in History from St. Stephen’s College, Delhi University, he is a retired IAS officer of Tamil Nadu cadre. During his tenure as an IAS Officer, he has held important positions for both Government of India and the Government of Tamil Nadu including the Economic Affairs Secretary, Revenue Secretary, and Fertilizers Secretary. In addition to that, he has represented India in various international forums like IMF, G20, SAARC, BRICS, etc., and has served as India’s Alternate Governor in the World Bank. As RBI Governor, he has been conferred “Central Banker of the Year, Asia-Pacific 2020” by The Banker, a financial publication of The Financial Times Ltd, for making the banking system more robust.

And that brings us to the end of this newsletter!

Still reading? We’re glad.

Surely you must like the newsletter then!

Please consider supporting us by sharing it on LinkedIn, WhatsApp, or Facebook, or leave us some feedback on what you love or hate about it!